2023 Commercial

Real Estate Outlook

Questions About The Retail Sector? Contact Us.

Call Kelleher & Sadowsky:

508-755-0707

2023 Commercial Real Estate Outlook

January 2022

- Geopolitical Issues. The war in Ukraine and sanctions on Russia have caused supply chain issues and higher prices for energy, transportation, food, and shelter.

- High Inflation. The new year began with inflation running at the highest level since the 1980s. Inflation can be especially problematic for commercial real estate landlords trying to maintain the gamut of property costs including energy, building services and labor.

- Rising Interest Rates: Until a substantial reduction in inflation occurs, it is widely expected that the Federal Reserve will continue to increase interest rates. Higher cost of capital will generally lower asset values of commercial real estate properties.

- Layoffs: Several major tech firms have announced large layoffs. These employee reductions are just the beginning and could provide other employers including banks and law firms with the ability to follow suit as well.

Alta Seven Hills (former Our Lady of Mount Carmel) (371 units) – WP East Acquisitions

Multifamily

Housing is traditionally one of the most sensitive sectors in the economy related to changes in interest rates. However, demand for multifamily housing has held up amid a tight single-family market and affordability challenges given the rapid rise in mortgage rates.

According to Moody Analytics, multifamily ended 2022 as the highest performing of all commercial real estate asset classes, with vacancies at five-year lows of 4.4% and multifamily housing starts close to the highs of the cycle.

In Worcester, especially in the areas near Polar Park and the Canal District, developers are racing to meet demand with large multifamily projects due to come online in the next 12-24 months:

- Brooks Street Commons (111 units) – GoVenture Capital Group

- 274 Franklin Street (364 units) – GoVenture Capital Group

- Alta Seven Hills (former Our Lady of Mount Carmel) (371 units) – WP East Acquisitions

- Polar Park Ballpark Campus (353 units) – Madison Properties

- Table Talk Lofts (350 units) – Boston Capital Development, LLC

- The Cove (former Lucky Dog Music Hall) (171 units) – V10 Development

- Walker Lofts (62 units) – Rossi Development

- 44 Grafton Street (former Fairway Beef) (105 units) – AKROS Development

- 5 Madison Street (110 units) – Winterspring Capital, LLC

- 225 Shrewsbury St. and 68 Albany St (218 units) – Lundgren Equity Partners

- 139 Green Street (former Smokestack Barbecue location) (375 units) – Quarterra Multifamily Communities

The Cove (former Lucky Dog Music Hall) (171 units) – V10 Development

There may be an upside to rising interest rates for multifamily owners and investors, too, as higher interest rates may cause potential homeowners to remain renters for longer.

Rising costs due to inflation may put additional pressure on landlords to maintain profitability of their multifamily properties. But often they can adjust rents annually—sometimes even monthly—to account for market changes.

The question then becomes at what point can the market support sky-high rents? In Worcester, market rates for new one-bedroom apartments coming online are between $1,750 and $2,000, and two-bedroom apartments between $3,000 and $3,500, and even higher in some cases.

Central Gateway, Leicester (280,000/SF) – April 2023 occupancy

Industrial

E-commerce had been the driver of warehouse and distribution space for more than a decade. During COVID, consumer spending surged and demand for industrial space went to another level.

For the past three years, competition in Worcester, Central Massachusetts and the MetroWest region for quality warehouse and distribution center space has been fierce. The players involved included traditional and online retailers like the TJX Companies, Walmart, Target, Best Buy and Amazon; as well as third party logistics players like FedEx and UPS.

These companies all want nimble supply chains so they can deliver last-mile inventory in urban areas with a high population density. They expect efficient, new, modern warehouse/distribution centers for robotics, along with 32’ to 36’ clear heights for increased efficiency and racking capacity. One problem: there was an undersupply of such modern industrial space in the region. As a result, high demand coupled with low supply caused industrial vacancy rates to hover near an all-time low of 4% and spiked lease rates and property values to all-time highs.

As we begin 2023, the supply of quality warehouse and distribution space is changing. New industrial projects started during the pandemic are now coming to completion.

Within a ten-mile radius of Worcester, there is more than 5 million square feet due to come online over the next twelve months. Some examples include:- Uxbridge Distribution Center, Uxbridge (600,000/SF) – Ready for occupancy

- Lackey Dam Logistics Center, Sutton (180,000/SF) – Build to suit

- Central Gateway, Leicester (280,000/SF) – April 2023 occupancy

- 80 Pine Hill Drive, Boylston (400,000/SF) – Ready for occupancy

- Centech Park North, Shrewsbury (310,000/SF) – Three buildings all nearing completion

- 1 Simplex Drive, Westminster (360,000/SF) – Build to suit

- Lunenburg Central, Lunenburg (372,000/SF) – Brennan Group

- 135 Brooks Street, Worcester (240,000/SF) – Criterion

- 440 Hartford Turnpike, Shrewsbury (134,000/SF) – In permitting by GFI Partners with December 2024 delivery date

- Former Worcester Sand & Gravel site, Shrewsbury (1,400,000/SF) – In permitting by GFI Partners with 2024 delivery date

The completion of these new industrial projects combined with a slowing economy will undoubtedly drive-up the vacancy rate of warehouse space in the region and new building starts will slow down until a significant amount of this space is absorbed. With that said, 2023 industrial leasing is projected to remain robust, with logistics companies filling vacancies that were unavailable as early as a few months ago.

If such a construction pullback occurs, it is possible that a warehouse shortage could occur in 2024 or 2025.

WuXi Biologics $300 million biomanufacturing facility at The Reactory in Worcester scheduled to open 2024

Life Sciences

Life sciences was one of the strongest commercial real estate asset classes in the region the past few years. Leasing activity was turbocharged by COVID, low interest rates and an abundance of investment dollars. During this time, lab real estate garnered the most interest.

Entering 2023, interest in lab space has lessened east of Route 128 because of rising interest rates and decreasing capital investment in life sciences companies. And, for the first time in a long while, there has been a big increase in lab sublease space available.

This surge of sublease space available in cities and towns such as Cambridge, Boston, Watertown, Waltham, and Bedford has the potential to impact leasing activity in Central Mass and the MetroWest region because biopharma companies may be less likely to “look west” when expanding.

Lab space in Worcester at the UMass Medicine Science Park is 100% occupied with a waiting line. Additionally, the 55 private incubator lab spaces at MBI are fully committed with “graduate companies” in need of space.

Biomanufacturing and hybrid lab space are expected to continue drawing interest from biopharma companies in Cambridge/Boston looking to manufacture nearby. Developers like King Street Properties and the Worcester Business Development Corporation have bet on a growing need to make the drugs discovered in those labs. The common idea behind their respective biomanufacturing campuses – Pathway Devens in Devens and The Reactory in Worcester – is that as new drugs go into clinical trials, researchers will need to be able to visit frequently to iron out production problems and other tasks.

As Massachusetts biopharma companies continue to ratchet up their manufacturing capabilities in the region, competition for the state’s limited industrial real estate may increase even more, backfilling space that had previously been eyed by e-commerce giants.

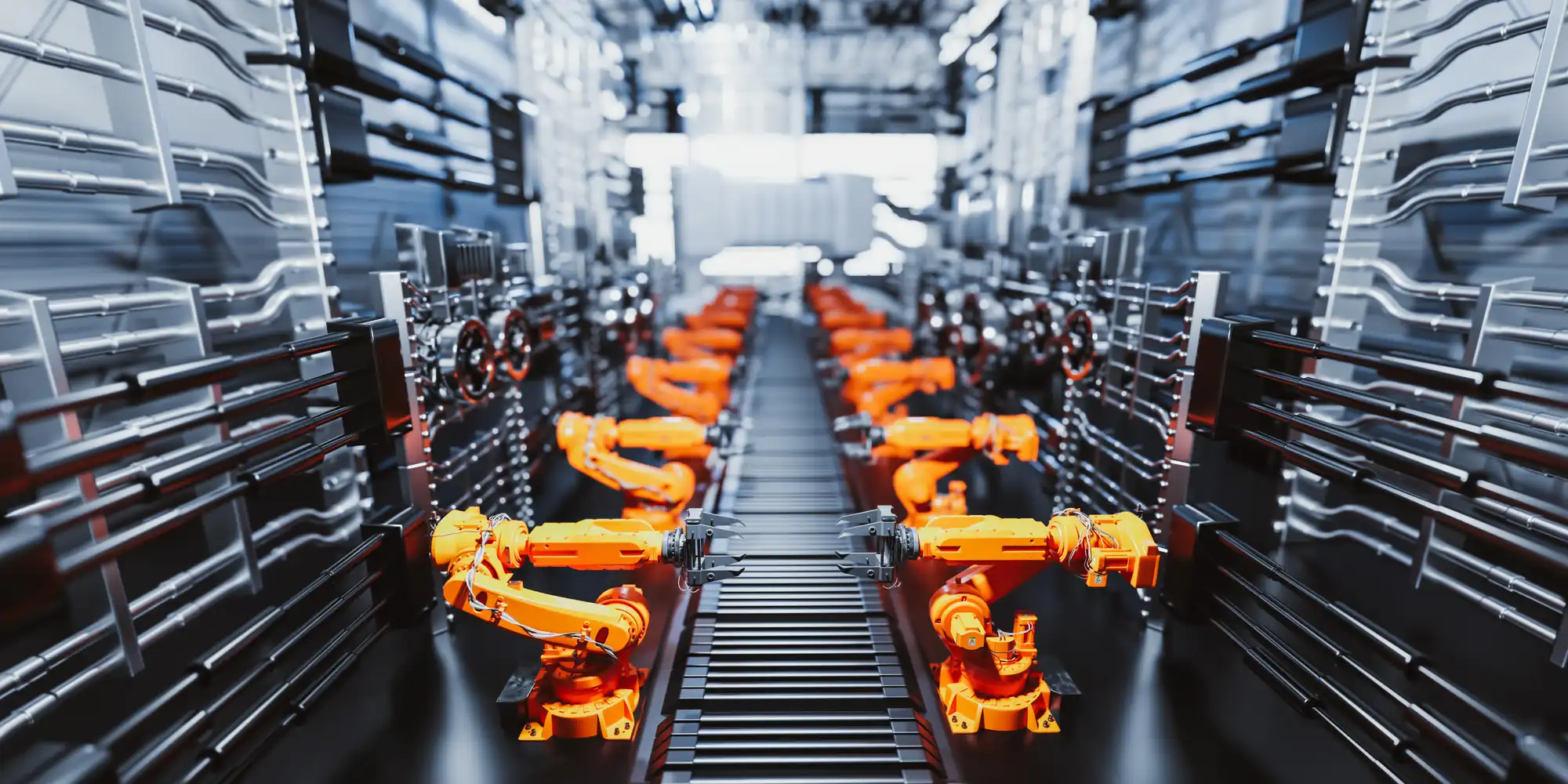

Manufacturing

The manufacture of drugs, computer chips, communications equipment, medical devices, robotics and consumer goods are all growing in our region due to innovation and a skilled labor pool.

The recent CHIPS and Science Act legislation promises to help companies to develop shorter, more resilient, and more adaptable supply chains and will encourage even more manufacturing in the region.

An ISM survey of 300 manufacturers expects production capacity to increase by 5.3% and labor to increase 3.9% in 2023.

Increased capacity and labor ultimately translate to an increase in demand for manufacturing facility real estate. There is, however, an undersupply of quality, ready-to-build manufacturing spaces in the region. Retrofits of older industrial spaces and conversions are becoming more and more common.

As an example, Aspen Aerogels, a maker of batteries for the electric vehicle market, selected the former Sports Authority in Marlboro for its new manufacturing location. According to an Aspen Aerogels media communications, the former big box retail store on Donald Lynch Boulevard provides an ideal location for its workforce and customers, easy access for logistics and talent recruitment, and the opportunity for expansion.

We are beginning to see demand in the clean energy and renewable energy sector of the market. Those companies will need high tech manufacturing with heavy power demands.

Iconic 111 Speen Street office building in Framingham currently undergoing extensive refresh

Office Space

Office space vacancies has grown steadily since the COVID-19 pandemic with 2022 ending with vacancy rates in the suburban region of greater Boston at 15.83%, according to CBRE.

Adding to office space woes is a surge of sublease listings in metro-Boston, especially amongst tech companies many of which recently announced layoffs, including Microsoft, Amazon, Meta, and Twitter.

All of this adds up to the new year being a tenant’s market. For companies looking west of Boston, the ability to secure quality space at a good value is the best it has been in a while. This value proposition can translate to affordable lease rates, abundance of parking, and improved accessibility.

It can also translate to a “flight to quality” whereby companies step up to improve and adjust their office environments. Think optimized floorplans for collaborations, private outdoor spaces and onsite services like childcare and catering. It may be just the incentive to bringing employees back to the office.

An example of this recently occurred in the MetroWest region when Ai3 Architects decided to relocate its headquarters from Wayland to 111 Speen Street in Framingham. The timing was perfect for the architectural firm to realize maximum value – securing high quality space that’s attractive to its employees at a tremendous value.

In Worcester, the pieces are coming together for the city to attract companies considering relocation or satellite/back-office locations. Downtown is brimming with amenities, including new upscale housing, restaurants, and entertainment options. Employee commute times are negligible. And average lease rates are $15-$25 less per square foot than comparable space in downtown Boston.

Retail

Post-pandemic, the retail segment for commercial real estate has been strong. For the first time since 1995, more new stores are opening than closing, and some analysts expect this trend to continue despite fears of a recession in 2023.

The region west of Boston is growing steadily. Worcester’s population of 211,612 grew 14.1% between 2010 and 2020, making it the fastest-growing city over 100,000 people in New England. Central Massachusetts’ population grew 8.1% from 2010 to 2020, outpacing both the state (6.0%) and nation (6.5%). And the 495/MetroWest region’s population increased by 44.4% from 1970 to 2018, compared to 20.1% statewide.

Improving rail service, work-from-home, and continued migration of Boston companies to the west are causes for optimism that the towns and cities west of Boston will continue to grow. For retail site selectors, this is exactly the environment that they seek for new store locations.