Worcester Business Journal

April 2023

The interior of 200 Donald Lynch Boulevard in Marlborough buzzes with construction workers installing new wall studs and HVAC equipment, as a large part of the building undergoes a transformation from office space to lab space.

The shift follows post-COVID market demand after workers got used to working from home and the bottom dropped out of the office market. Building owner Minardi LP of Worcester was looking for a tenant for 200 Donald Lynch, which once housed software company SanDisk.

Sartorius AG, a German life science giant was looking for more space to expand beyond its facility down the road at 450 Donald Lynch, once home to WaterSep BioSeparations, which Sartorius acquired in 2020. So, the company agreed to lease more than 50,000 square feet of space in the office building at 200 Donald Lynch and invest $20-$40 million in converting it to lab space.

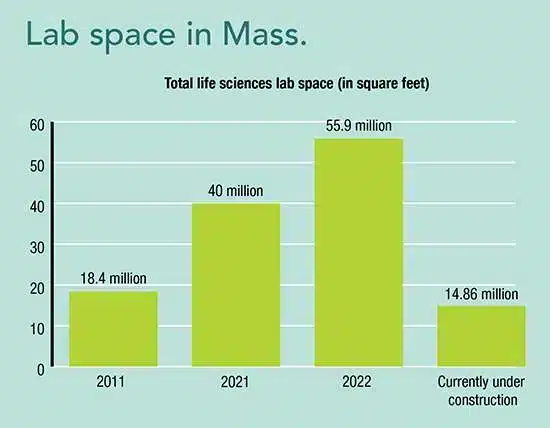

Total life sciences lab space in Massachusetts in square feet

Converting underused office buildings or old mill buildings into adaptive reuse is one way property owners and developers are luring more life sciences companies and investment into Central Massachusetts. But not all spaces are suited for lab space or biomanufacturing due to low ceilings, lack of loading docks, or inadequate infrastructure. Sometimes a developer is better off building new, even amidst high construction costs in order to meet tenant needs.

Developers and brokers are using multiple strategies to bring life sciences companies out past Route 128 in Massachusetts. They cite less expensive real estate, a strong talent pool, shorter commutes, and increasing amenities like culture, sports, and food as reasons to set up shop in Central Massachusetts.

Philip DeSimone, executive vice president at Worcester real estate brokerage Kelleher & Sadowsky Associates said the life sciences market was extremely strong through 2020 and 2021 due to lots of venture capital investment, low interest rates, and the fact the pandemic was profitable for some biotech companies in Boston and Cambridge.

Philip DeSimone, executive vice president at Kelleher & Sadowsky, has helped lead the conversion of office space in Marlborough into life sciences space.

Things have cooled off since then because of rising inflation, and the jump in interest rates meant to fight inflation is causing investment money to dry up. Larger life science companies that leased space for expansion began to change their minds and sublease that space, DeSimone said.

“The life science market is on more of a pause than a stop,” DeSimone said. “Investment will come back. Massachusetts is the life science capital of the world.”

“If you take out all the lab space in Cambridge, it’s still the capital of the world,” said Andrew Sherman, vice president at Kelleher & Sadowsky.

The Advantages of MetroWest

DeSimone, Sherman, and Kelleher Vice President Brian Johnson brokered the deal between Minardi and Sartorius at 200 Donald Lynch Drive. They are optimistic the suburbs of MetroWest, particularly around Interstate 495, will continue to see a lot of life sciences activity because it offers workers who live in the suburbs of Boston an easy commute.

Route 128 and I-495 form roughly concentric semi-circles outside of Boston and are used as informal regional markers. I-495 is approximately 17 miles west of Route 128 on the Massachusetts Turnpike, which runs east to west through the center of the state, and Route 128 is approximately 10 miles outside of downtown Boston.

“Just like the office workers who don’t want to go into Boston that live in the communities around 128 … the life science employees don’t want to do it either,” DeSimone said.

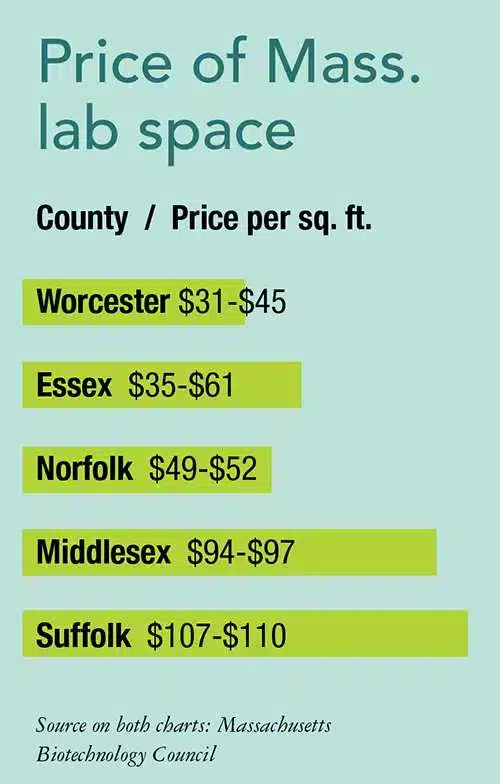

Lab workers can do much of their work from home now and go to the lab less frequently so companies would rather pay less outside of Boston and Cambridge. DeSimone and Sherman said that generally life science space in Boston is more than $100 per square foot, while around Route 128, it’s $60-$80 per square foot, and around I-495, it’s $40-$50 per square foot.

The price of lab space in Massachusetts by county per square foot

Building out Worcester life sciences

Further out in Worcester, the market suffers from a lack of lab space, said DeSimone. This poses a problem for the companies coming out of local incubators and colleges. They can’t find existing lab space in the city, so they are going to MetroWest for space.

“Investors and developers are saying, ‘If I were to build a building, say on 495 or in Worcester, I need $60 to $70 rents just to make the math work,’” said DeSimone.

Mike O’Brien, principal of Webster developer Galaxy Life Sciences, is betting on the life sciences industry in Worcester growing. His company in February purchased the final lots at The Reactory, a site purchased by the nonprofit Worcester Business Development Corp. to develop into a biomanufacturing park.

Galaxy Development's Michael O'Brien

Chinese manufacturer WuXi Biologics is investing $300 million in a 190,000-square-foot biomanufacturing site at The Reactory, making it an anchor tenant on the campus and the only company to have publicly committed to the property. Its facility is under construction.

At The Reactory, Galaxy had been building a 90,000-square-foot facility on spec called the Galaxy Life Sciences Building. A client, who O’Brien would not name, took interest in the building, and now Galaxy is adding up to 50,000 square feet to the project to accommodate the client’s needs.

Galaxy has one remaining pad at the site, though O’Brien is waiting to finalize a lease deal to build a facility, because of the expense of construction. Construction costs have not come down at all since the spike in 2022, O’Brien said.

The Worcester biomanufacturing campus The Reactory is being developed out of the former site of the Worcester State Hospital.

“It’s crazy to put up the steel if it’s not going to fit tenant demand,” he said.

Tyson Reynoso, managing director at King Street Properties, has a different approach. In order to respond to the potential tenant volatility among life science companies, his Boston-based development company builds for the industry, not for the tenant, Reynoso said at the WBJ Central Massachusetts Life Sciences Forum on March 7.

“Obviously, each tenant has its own specific needs and you have to be able to accommodate that,” said Reynoso.

King Street works with tenants to get the right mix of office, lab, and manufacturing space they need, but Reynoso said he wants to build a space to appeal to the broader market if things don’t work out for that tenant. Revenue for life sciences companies is notoriously volatile, as early stage companies rely on grants and investors to fund research, development, and regulatory approval before products make it to market.

Tyson Reynoso, managing director of King Street Properties

King Street is developing a five-building, 750,000-square-foot biomanufacturing campus in Devens, called Pathway Devens, on the heels of completing a 165,000-square-foot manufacturing facility for energy company Commonwealth Fusion Systems in Devens.

Devens is a regional enterprise zone stretching through Ayer, Shirley, and Harvard west of I-495 on Route 2, a highway spanning northern Massachusetts from Cambridge through Fitchburg and out to Pittsfield. Devens is the site of a former military installation, Fort Devens, and has been the site of significant redevelopment. The state agency MassDevelopment has streamlined the process for development, and Reynoso said developers can get a project permitted within 75 days, a process that can take years in Boston or Cambridge.

Developments, high and low

Though construction costs remain high, and the economy, including the life sciences sector, is still finding out how the collapse of Silicon Valley Bank will affect everything, Central Massachusetts seems to be preparing for continued growth of the industry.

Samuels & Associates of Boston and California property owner Alexandria Real Estate Equities are planning a 750,000-square-foot biomanufacturing campus in Westborough. The property included the former headquarters of retailer BJ’s Wholesale Club.

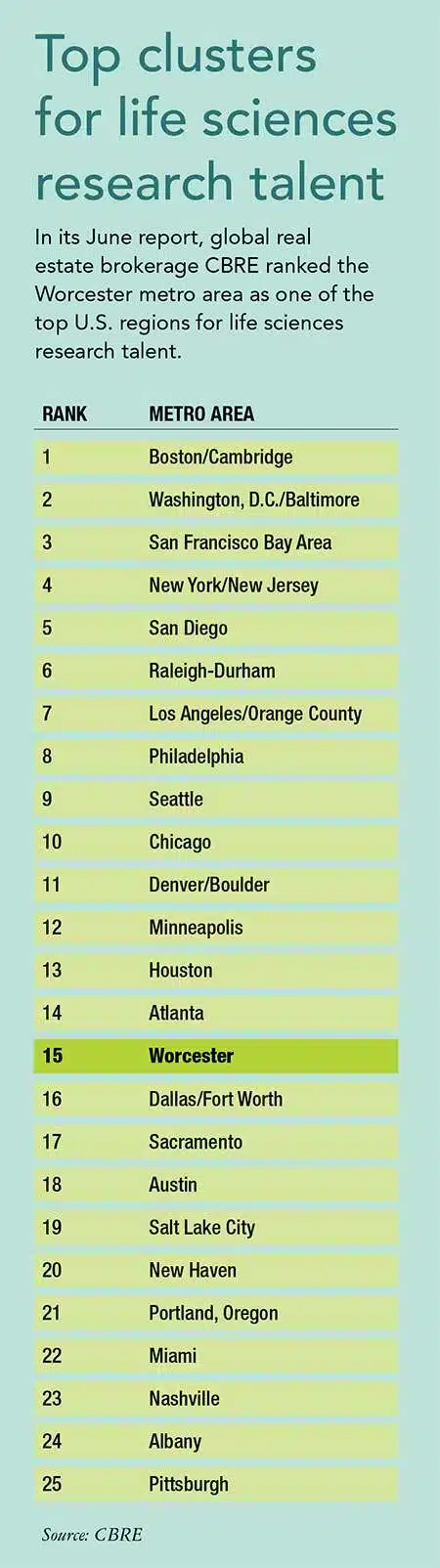

In Worcester, WBDC in November took control of approximately 51 acres of underused land from manufacturer Saint Gobain for redevelopment. The space is not exclusively earmarked for biomanufacturing, but that is one possible use for the land. In June, Greater Worcester was ranked as being the 15th best region nationally for life sciences research talent, beating out metro areas like Dallas, Sacramento, and New Haven, according to the ranking by real estate giant CBRE.

In North Worcester County, Clinton-based Cunningham Equities is working on Turning Point Campus, a 235,000-square-foot life-science manufacturing facility in Fitchburg. In total, the campus will offer 250,000 square feet of manufacturing space, a separate 5,000-square-foot research lab, and a 20,000-square-foot warehouse.

The project has an unidentified anchor tenant to occupy 85,000 square feet, and Cunningham Equities is in negotiations with another potential life-science tenant, said James Cunningham, the firm’s managing director. Cunningham sees potential for life science companies to adapt the mill buildings in Northern Worcester County, particularly along the Nashua River, for biomanufacturing, he said. Fitchburg State University is producing lab technicians who are forced to move away from the area to be closer to other life sciences clusters, when they would prefer to remain in the area.

About an hour down Route 2 from Cambridge, Cunningham said developing a cluster in North Central will not be quick, but he is counting on it happening.

“The life-science crawl to the west is happening,” he said.

By Timothy Doyle

Worcester is ranked #15 among clusters of Life Science talent.