From Office Floors to Front Doors: Worcester’s Apartment Surge

Interested in Investing in Worcester? Contact Us.

Call Kelleher & Sadowsky:

508-755-0707

The Challenges

The Projects in Motion

One Chestnut Place – Synergy Investments is spending roughly $73 million to turn this 11-story tower into 198 market-rate apartments. Incentives include a $2.5 million Housing Development Incentive Program (HDIP) award and a 15-year tax increment exemption worth nearly $4 million. Construction began this summer.

Two Chestnut Place – Next door, the four-story building is being transformed into 22 affordable condominiums for first-time buyers at or below 80% of area median income. It’s fully financed with $8.1 million from the CommonWealth Builder program, $2 million from the city’s Affordable Housing Trust, and $4.2 million in private capital.

Slater Building – This ten-story historic landmark at 390 Main Street is under feasibility review by WinnDevelopment through the state’s Commercial Conversion Initiative.

204 Main Street – The Menkiti Group is redeveloping the property into 20 workforce apartments over ground-floor retail, stacking HDIP and historic tax credits, a $650,000 MassDevelopment grant, and city-approved tax relief. Ground broke in June.

Why Apartments Are the Play

The Incentive Stack

Developers here aren’t doing these conversions blind—they’re leveraging robust public programs:

- HDIP for state tax credits and local property tax breaks.

- CommonWealth Builder for moderate-income homeownership projects.

- Historic Tax Credits for eligible structures.

- Tax Increment Exemptions (TIEs) to ease property tax burdens during lease-up.

These tools turn projects from marginal to bankable.

The Bet on Worcester

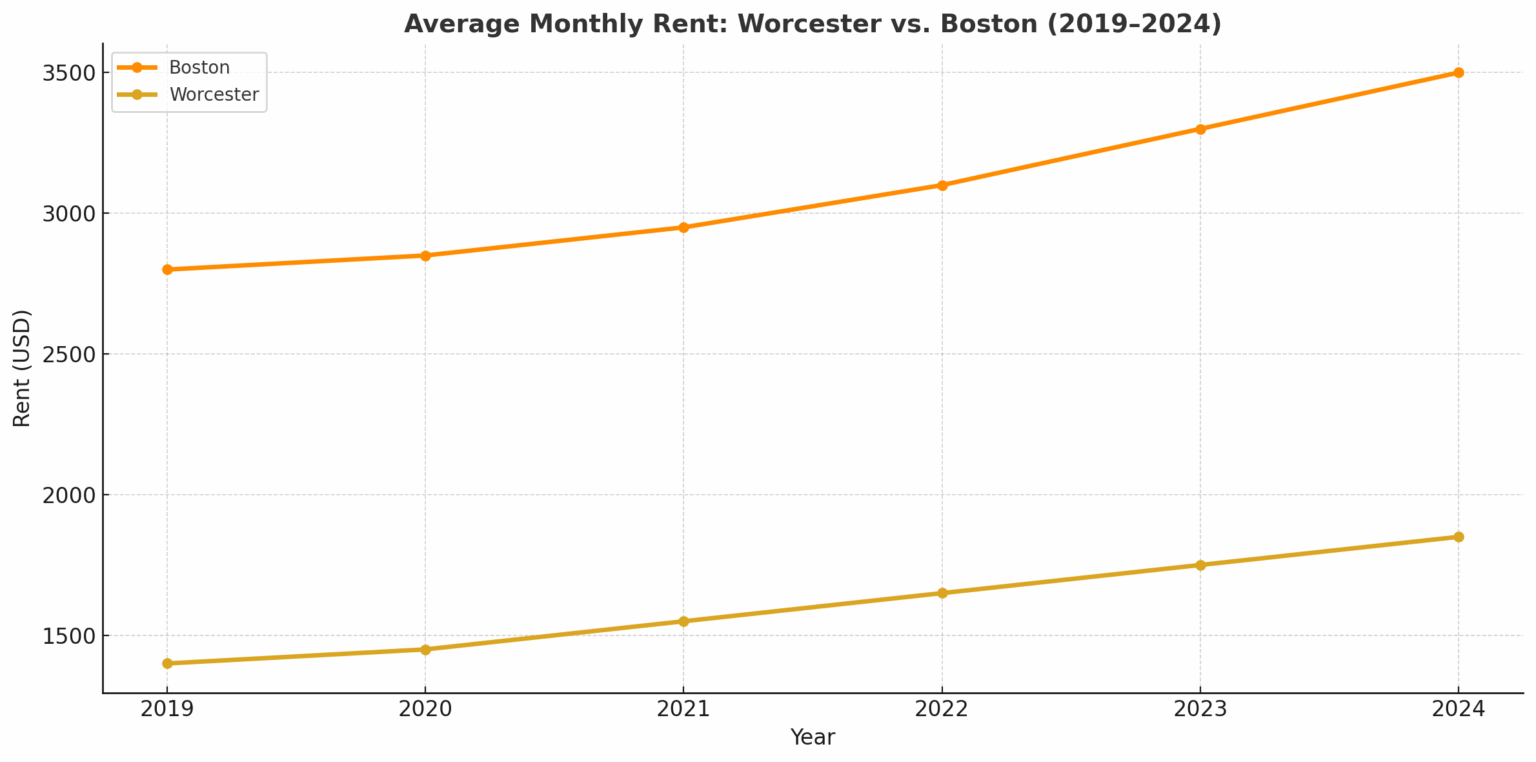

Worcester is the second-largest city in New England and, by percentage growth, the fastest-growing. People are coming for more than cheap rent—they’re coming for a city with balance:

- A serious restaurant scene for foodies.

- A cultural life anchored by theaters, galleries, and music.

- Year-round sports and entertainment, from Polar Park to the DCU Center.

- A cluster of colleges feeding talent into the economy.

- Job opportunities in healthcare, education, tech, and professional services.

- Quick access to hiking, skiing, and beaches.

- Direct commuter rail to Boston.

Worcester’s growth is no longer a theory. In that mix, office conversions aren’t just buildings changing use— they’re part of a growth trend with room to run. For investors, the opportunity to invest in office-to-residential conversions is right now, while demand is surging and supply is still catching up. The savvy move is to get in before Worcester’s growth is fully priced in.

####

For information about commercial real estate opportunities in Worcester, Central Massachusetts or the MetroWest region, contact Kelleher & Sadowsky. With more than four decades experience, our team can often see inside the many particulars of a potential transaction and find ways to add value and creative solutions that others might not see.