The Race Is On For Lab And cGMP Space

Questions About Life Sciences Space? Contact Us.

Call Kelleher & Sadowsky:

508-755-0707

CRE Market Insight: Life Sciences Sector

August 2022

After several years of red-hot growth, the market for commercial real estate in the life sciences sector has slowed during the first half of 2022. The downturn is mainly due to funding for life sciences companies being impacted by rising interest rates and inflationary pressures. IPO activity has slowed as well. In the first half of 2022, just 14 biotech startups went public, compared to 61 the first half of 2021.

In response, there has been an increase in layoffs with about 20 companies in the region announcing about 1500 layoffs so far this year. Not surprisingly, there also has been an uptick of short-term sublease activity.

Companies fortunate to be expanding and looking to secure long-term leases are entering a market with high occupancy rates enabling landlords favorable leverage pricing rents.

Despite these macroeconomic headwinds in the life sciences sector, the resulting slowdown seems to represent more of a market pause occurring after the pandemic years when the race for drug discovery and manufacturing overheated demand for commercial real estate space.

The laboratory development cluster in Greater Boston remains number one in the country. Lab inventory in the region has more than doubled in the last decade to over 41 million square feet, compared to 18.5 million in 2011. In second place, San Francisco trails Boston by nearly 10 million square feet!

Massachusetts has what it takes infrastructure-wise to support sustained growth in the life sciences industry. All the ingredients are here: venture capital funding, world-class hospitals, academic centers of excellence, and – most importantly – an educated and trained workforce to fill office, laboratory, and manufacturing positions.

Tenant Space in Cambridge and Boston Is Difficult to Find

Occupancies in life science properties in Cambridge and Boston are essentially full, with vacancies below 3% for more than four years. In response to these favorable landlord conditions, rents have continued to climb. Starting rents above $100/SF are now the norm in Boston, and several Cambridge deals have exceeded $100/SF.

Finding value in Kendall Square, the Seaport District and the Fenway area is a challenge. Increasingly, companies are looking beyond Cambridge and Boston to its urban edge (e.g., Somerville, Watertown, Charlestown) and along Route 128 (e.g., Newton, Waltham, Bedford). But the challenges involved in accommodating demand for space persist in these sub-markets as well.

Tenants Are Increasingly Looking Further West to Meet Their Lab and Manufacturing Needs

The expansionary migration of life sciences companies from Cambridge and Boston to Somerville and Watertown out to Waltham and Newton does not end at Route 128. Many tenants with a Boston/Cambridge presence are looking further west toward the suburbs to expand their footprint.

On their radar screen are locations such as Framingham, Westboro, Marlborough, Devens and Worcester. Here they are finding many of the important ingredients required by their location search, including value, accessibility, and trained talent.

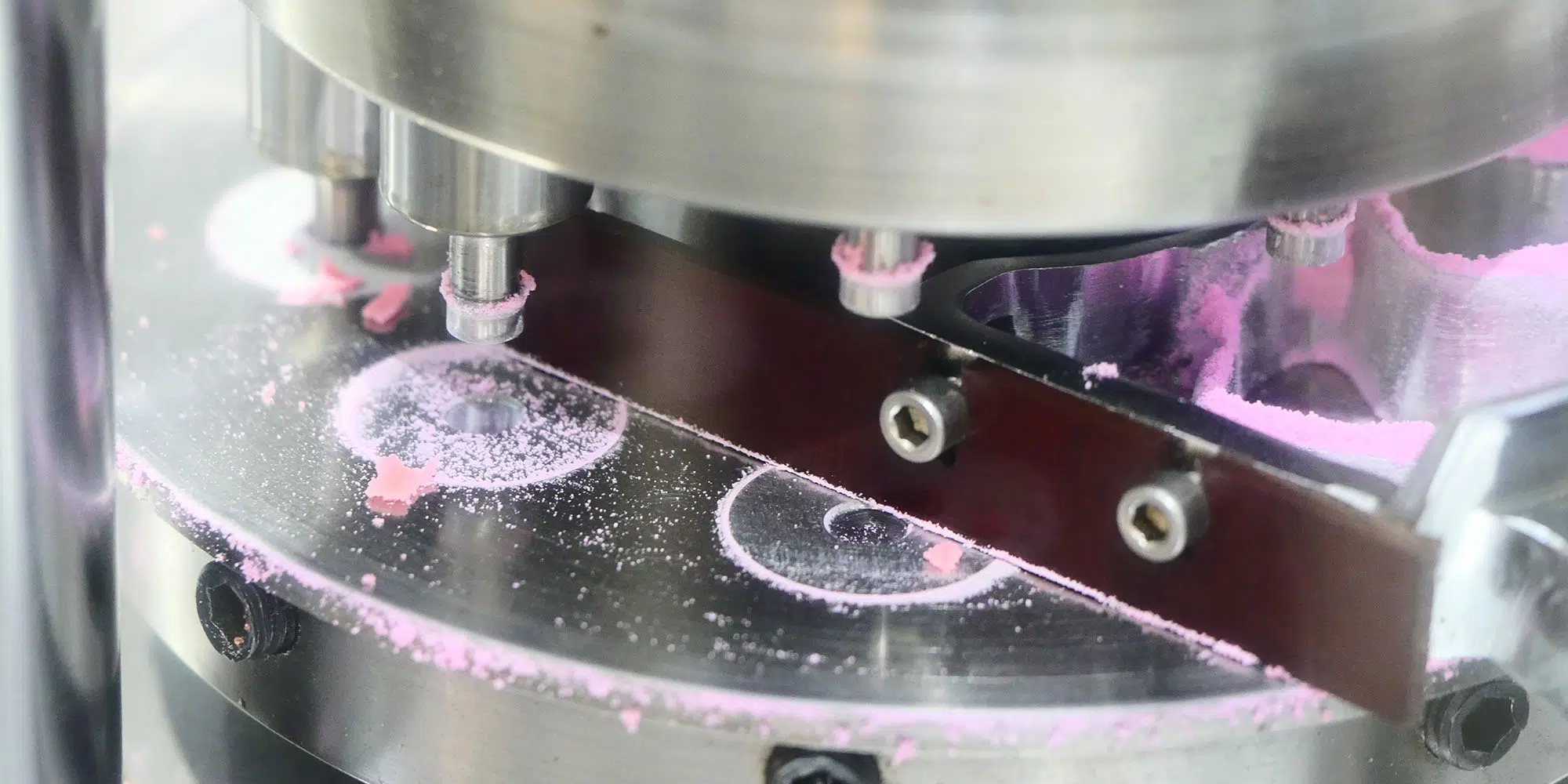

A key driver of searches in the region is finding facilities that can accommodate Current Good Manufacturing Practices. GMPs are standards enforced by the U.S. Food and Drug Administration (FDA) to ensure quality in the ingredients, manufacturing, and distribution of pharmaceuticals, as well as select other products such as cosmetics, medical devices, and foodstuffs. Meeting these standards can be onerous and exacting, giving life sciences firms an incentive to identify ways to streamline the process in the name of efficiencies. One way that life sciences firms achieve this is through locating in newer facilities with state-of-the-art technology support.

Another driver of searches is the critically low capacity of biomanufacturing in the metro-Boston region. The boom in mRNA vaccine technology and new cell and gene therapy firms has grown beyond the capacity of the region’s contract manufacturing organizations. This has had a tremendous impact on life science startups who outsource their therapy production or meet sudden demand and need these spaces to run clinical trials and work out manufacturing processes before making bigger real estate commitments.

Developers and Investors Are Racing to Find Space Throughout Central Massachusetts and the MetroWest Region

Developers and investors are sourcing opportunities for conversion projects and ground-up new construction projects throughout Central Massachusetts and the MetroWest region.

Conversions

Conversions are prevalent, as numerous buildings are well-suited to convert to lab space, including:

- Outdated office-to-lab

- Retail-to-lab

- Industrial-to-lab

An example of an office-to-lab conversion is 200 Donald Lynch Boulevard who recently signed a 56,174 square foot lease on two floors. The renovation is estimated to be over $20 mil.

Another example is the Bulfinch Companies’ acquisition of the former Neiman Marcus department store at the Natick Mall in December 2021 for $12.6 million. Bulfinch has proposed plans for a 135,000 square foot research and development facility including office, medical, and lab space.

Also last year, Sartorius Stedim Biotech, a manufacturer of laboratory instruments and consumables, converted an industrial warehouse space and opened a new 40,000 square foot Customer Interaction Center at 150 Locke Drive in Marlborough. This new site has enabled Sartorius to hire nearly one hundred employees in support of scaling up its operations and capabilities in the Cambridge/Boston hub.

A recent example of an industrial-to-lab conversion is the biomanufacturing company National Resilience and its acquisition of 92 Crowley Drive in Marlborough. The site already contained an existing 68,400 square foot research and development warehouse. Construction has begun to add 35,000 square feet to the existing facility in a project valued at $9 million. From its Marlborough facility, Resilience plans to provide cell therapy clinical manufacturing for Cambridge-based Be Biopharma, Inc., and other nearby companies.

New Construction

In Devens, Bristol Myers Squibb currently has a campus of 700,000 square feet on 89 acres. The company’s most recent addition was in 2021 when it added 244,000 square feet in support of new cell therapy development and manufacturing.

Also, in Devens, King Street Properties recently announced its first tenant within its planned 5-building $500 million life sciences complex. Pennsylvania-based Azur Group has agreed to lease 100,000 square feet at 45 Jackson Street where it plans to open one of its Cleanrooms on Demand facilities, which biotech and other life sciences companies can rent out to manufacture their products.

45 Jackson Street represents Kings Street Properties’ first building at Devens and was built “on spec”. Life sciences companies often need space faster than it can be built, forcing developers to launch projects without a tenant signed. Prior to the pandemic, developers often balked at that sort of bet. Post-pandemic, the demand for space in the region appears to have changed the rules of the game.

In Worcester, at The Reactory’s 46-acre campus, WuXi recently announced plans to expand its planned 107,000 square foot biomanufacturing facility and increase its bioreactor capacity so as to support increased demand for onshoring in the U.S, Wuxi’s investment in Worcester has grown from $65 million to approximately $300 million. Also, at The Reactory, Galaxy Life Sciences, bought a 6-acre parcel, has started construction, and is seeking tenants to bring to the expanding campus’ 500,000 square feet. In downtown Worcester across from Polar Park where the WooSox play, Madison Properties has begun developing a six-story 200,000 square foot building. Both Galaxy Life Sciences and Madison Avenue have begun construction such that final development can be completed in 12 to 15 months once a lease is signed.

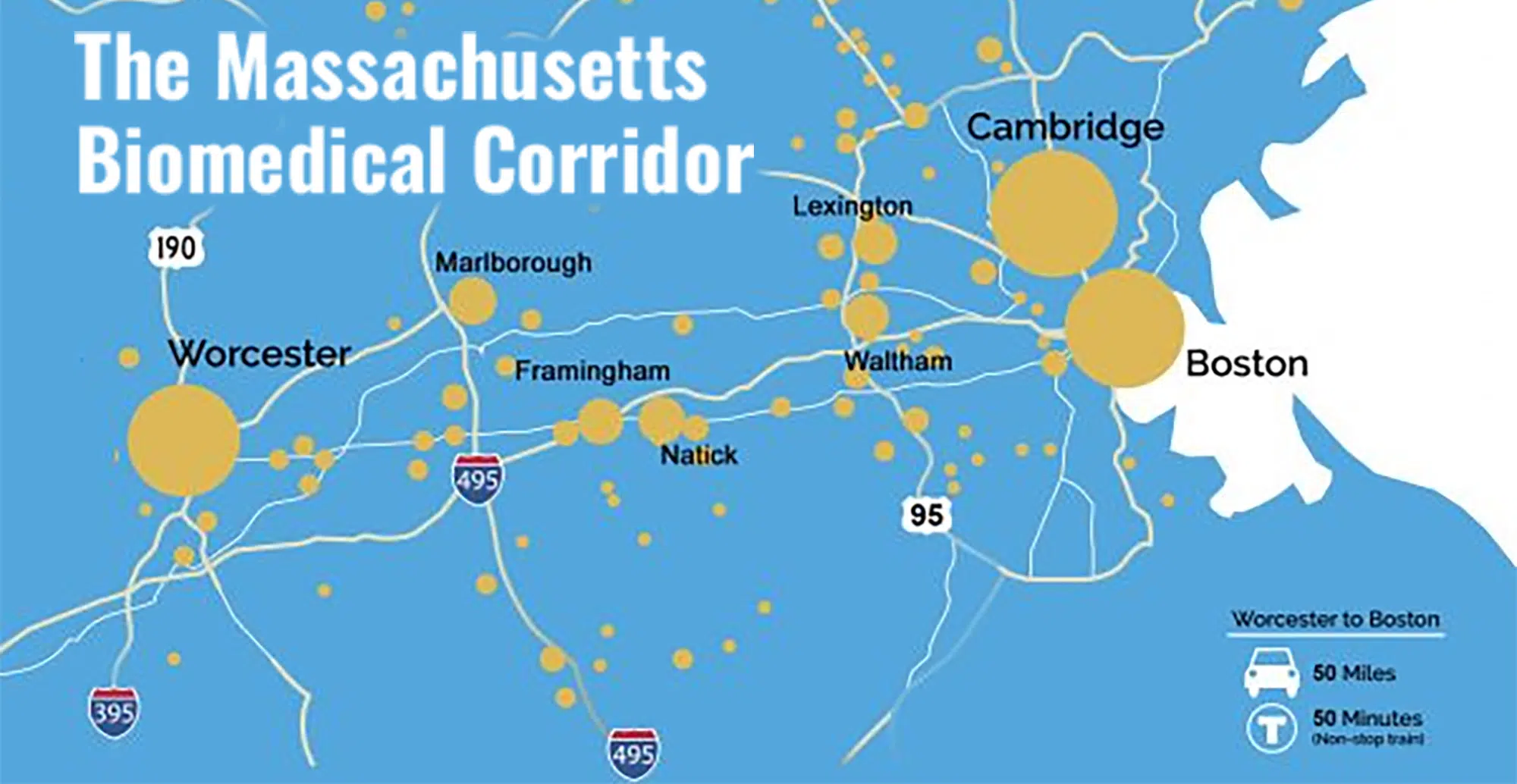

The Biomedical Corridor Between Cambridge and Worcester Has Talent

Life sciences employment has grown 131% in the last 15 years, adding almost 60,500 jobs for a total of 106,600 in Massachusetts. With additional lab and manufacturing space under construction across the state, projections are that 40,000 more jobs will be added to the sector by 2024.

Here is the challenge: In a 2022 survey of 129 biopharma companies in Massachusetts, MassBio found that 78% expect to grow their workforces over the next year but have had trouble filling open positions.

Central Mass and the MetroWest region with its deep and talented workforce offer a solution to this recruitment dilemma for these biopharma companies. Worcester County already has 20.4% of the state’s biomanufacturing jobs, second after Middlesex County’s 45.2%,

In a recent national study, Worcester was ranked 15th among top life science research talent pools, just after Atlanta and before Dallas/Fort Worth.

Plus, working in the Central Mass and the MetroWest region allows employees the opportunity to live in homes that are more affordable than in metro-Boston. And the commute is so much better!

So, if your pharmaceutical or biotechnology company wants to expand its operations or you are an investor searching for space to develop, consider looking to the west of Boston. You may very well end up joining other top pharmaceutical and biotechnology companies who have expanded their footprint outside Cambridge and Boston, including AbbVie, AstraZeneca, Biogen, Bluebird Bio, Boston Scientific, Bristol Squibb Meyers, Charles River Laboratories, Cytiva, IDEXX Laboratories, Johnson & Johnson, Moderna, Mustang Bio, Paraxel, Pfizer, Regeneron, Roche, Sanofi, Sunovion Takeda Pharmaceuticals, Thermo Fisher Scientific, Vertex Pharmaceuticals, Waters, and WuXi Biologics.

###